401k calculator with payout

If you want to customize the colors size and more to better fit your site then. This might mean you have a new plan with your new employer or that the funds can.

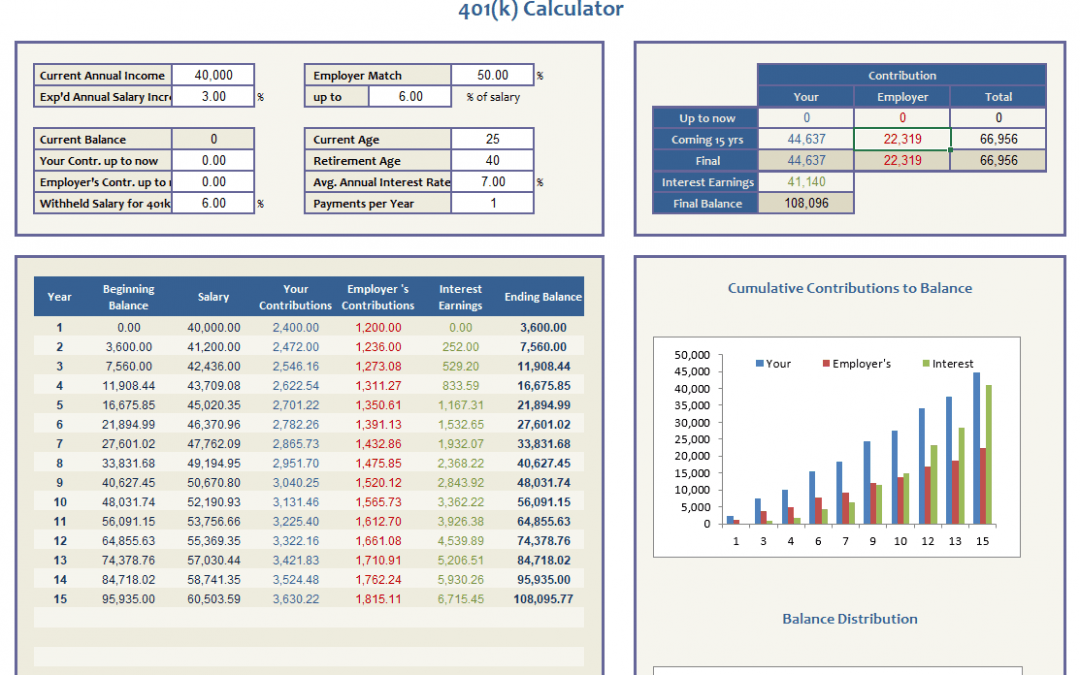

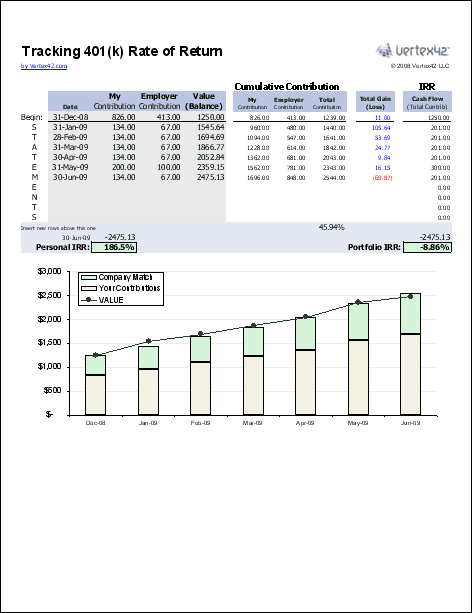

401k Calculator

Provides a specified cash payout in the event of the insureds death during the predefined time period covered.

. PTE CRPA TM is easy to use. SmartAssets retirement calculator looks at your current and projected savings to determine whether youre on pace for a secure retirement. Evaluate my company pension payout options.

With our annuity calculator you can easily know exactly how much money it will take to retire in the quickest way possible. Discuss how much you should contribute to an IRA. Our 401k plans have multiple investment options and matching contributions with gradual vesting on the EY matches beginning with two years of service and 100 vesting after five yearsOur pension plan helps you plan for your retirement and includes early retirement options lump-sum or annuity payout options and pre-retirement survivor.

Often your employer s 401 k doesnt allow them to pay you out with a check if your old 401 k account contains more than 1000. Many clients purchase income annuities to help cover their essential expenses as defined by them in retirement. And of course because it is a spreadsheet you can delve deep to figure out exactly how the formulas work.

These payments are also called SEPP payments. Heres how it works. - solve for the principal required.

Employers dont have a specific 401k contribution limit placed on them but the IRS limits 401k contributions from all sources including employer match to 56000. Calculate the benefit of investing now rather. How we calculate is simple.

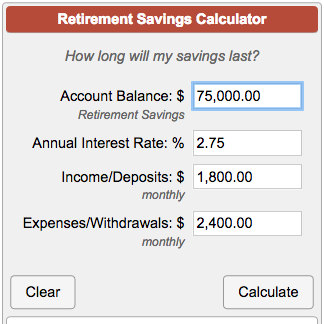

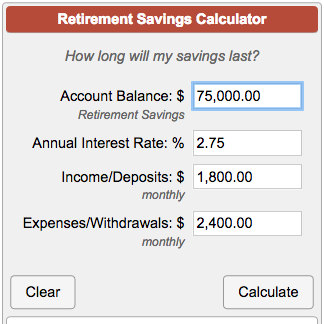

Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary 401K Interest Rate Sales Tax More Financial Calculators. After completing the rollover you apply for a 72t substantially equal periodic payments SEPP. Calculation of the payout length in years.

Then you ROLL your 401k into an IRA. You make monthly payments and we give you 3 interest on. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount.

Morningstar Envestnet Schwab Advent etc. 529 State Tax Calculator Learning Quest 529 Plan. Lets say you are still working but wantneed to retire lets say in this example at the age of 54.

Use this income annuity calculator to get an annuity income estimate in just a few steps. 401k Tax Advantage. Click here to learn more about the PTE CRPA TM Advantage.

401k Calculator - Estimate how your 401k account will grow over time. Example of 3 results. Input your assets and liabilities in the calculator to find your net worth.

On your Form 1040. The Substantially Equal Periodic Payment rule allows you to take money out of an IRA before the age of 59 12. 19000 x 2 38000.

Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on withdrawals. Calculate how to maximize your 401K benefits. If the account has between 1000 to 5000 the Internal Revenue Service generally requires that the company roll your funds to a new IRA account.

Annual Post-Tax Amount. Financial 401k calculator. Divide this up among the months youll live.

However there is a sizable risk risk taken by the investor since the payout may not be as high as projected and other factors relating to the time value of money. A Roth 401k gives you a similar tax me once advantage except that you get taxed at the beginning rather than the. How To Calculate Required Minimum Distribution For An Ira.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time. First you quit working.

However Due makes it simple. If youve inherit a 401k. Max Ramirez Hal M.

Roth 401ks are similar to regular 401ks except that contributions to the Roth account go in after-tax and withdrawals in retirement are tax-free. This first calculator shows how your balance grows during your working years. Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis.

Add the sum of all the payments. Advisors can integrate reports from any other program into the PTE CRPA TM report ie. Rollover IRA401K Rollover Options Combining 401Ks How to Rollover a 401K.

The IRS will offer you 3 optional payout methods. The mandatory payout rule doesnt apply to minors until theyve reached the age of majority at which point they have 10 years to empty the account they inherited. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution.

It also lets you avoid the 10 penalty taxThis approach is also called 72t payments because the rule falls under IRS code section 72t. In case of a plan that assumes an available principal amount of 200000 with a return rate of 5 and a desired withdrawal amount of 1500 expected month by month the results displayed are. Lets say you made your max 401k contribution at 19000 and your employer matches you dollar for dollar.

Add the interest received. Whether youre a large firm or a solo advisor compliance with PTE 2020-02 is not an option. Tax On A 401k Withdrawal After 65 Varies.

The net present value calculator exactly as you see it above is 100 free for you to use. For example in the payout schedule you can enter additional withdrawal amounts to either add to or reduce the amount of a withdrawal for a specific period. Maintain all Investor related documentation in.

- solve for the annuity payout.

Free 401k Calculator For Excel Calculate Your 401k Savings

Customizable 401k Calculator And Retirement Analysis Template

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Financial Calculators

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Stubhub Pricing Calculator Irs Taxes Irs Pricing Calculator

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Retirement Savings Calculator

Annuity Calculator Due

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Calculator For Excel 401k Calculator Savings Calculator Spreadsheet Template

Lump Sum Payments At Retirement Tcdrs

Retirement Income Calculator Tpc 401 K

Calculators Ipers

Personal Capital Retirement Calculator Plan 1 Retirement Calculator Retirement Planner Money Design

With Age Comes Great Responsibilities And At The Top Of Your List Should Be Taking Charge Of Your Money Www Levo Com Finance Personal Finance Budgeting Money

Retirement Withdrawal Rate Calculator Financial Calculators Retirement Calculator Retirement Portfolio