How much can you normally borrow for a mortgage

However as a drawback expect it to come with a much higher interest rate. By using our mortgage calculators we can help you understand key things like how much you can borrow.

7 Questions Answered About Getting A Dutch Mortgage In 2022 Dutchreview

If you do borrow more you could end up with two loans.

. To give you an idea of how much fees can add up before closing the appraisal on a single-family home can range from 313 to 420 according to HomeAdvisor. Your Guide To 2015 US. Mortgages normally take 25 30 or 35 years to pay back.

They work great if you already have a low-interest mortgage and dont want to. Set a sale price. Demand in the structured market for HMBS remains strong.

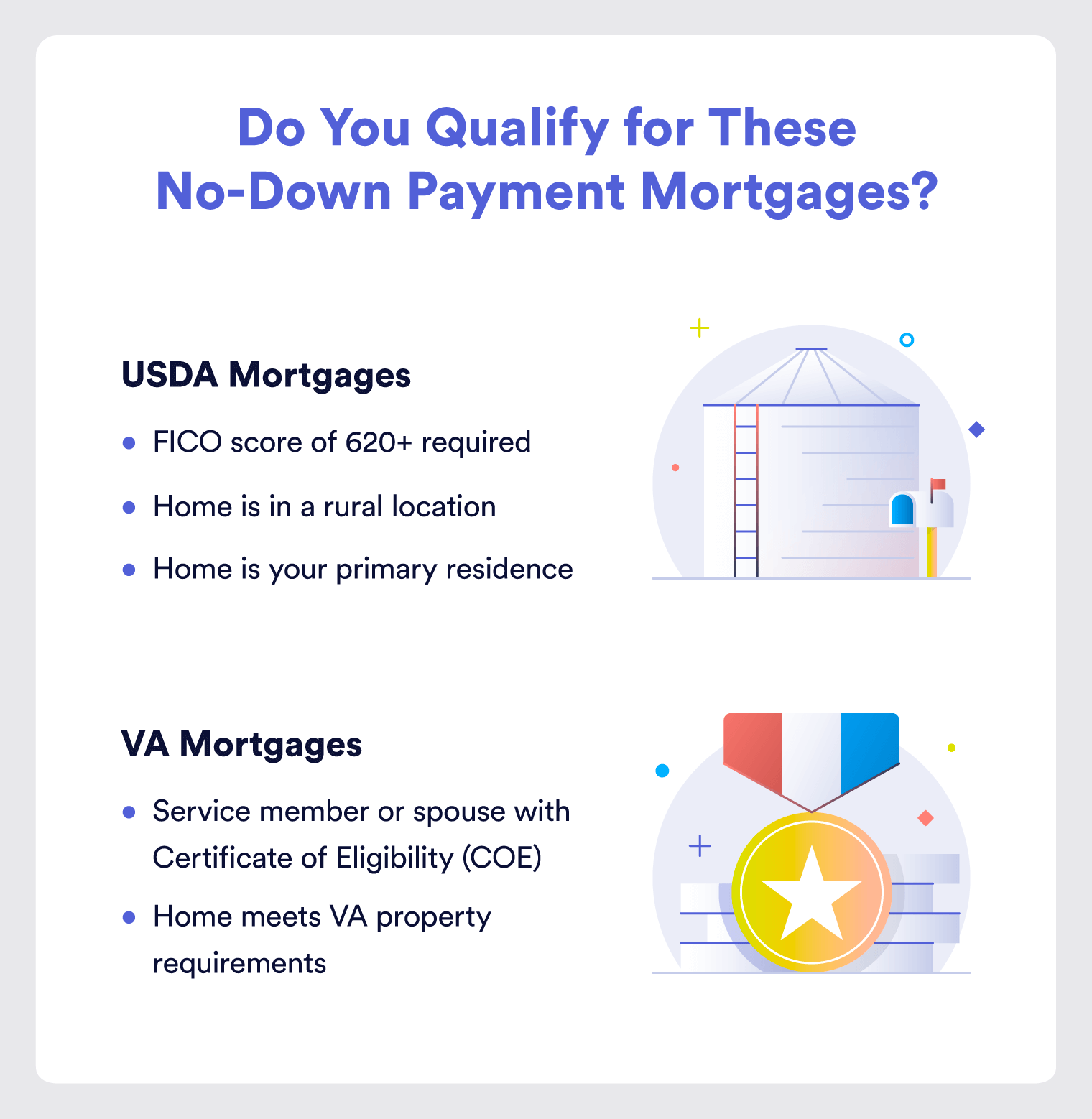

Our experienced loan experts will help you determine how much house you can afford and check if you qualify for one of our zero-down loans with no private mortgage insurance PMI. If youre in a financial bind a 401k loan allows you to borrow from yourself instead of a bank or a credit card. When to consider a refinance of your reverse mortgage.

You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. That is to say if your dream home is valued at 200000 euros the. Remember your borrowing power is only an indication of how much you can borrow.

Fannie Mae HomePath. Buying your first home with confidence. If you cant save enough some mortgages let you apply with a guarantor instead of a deposit.

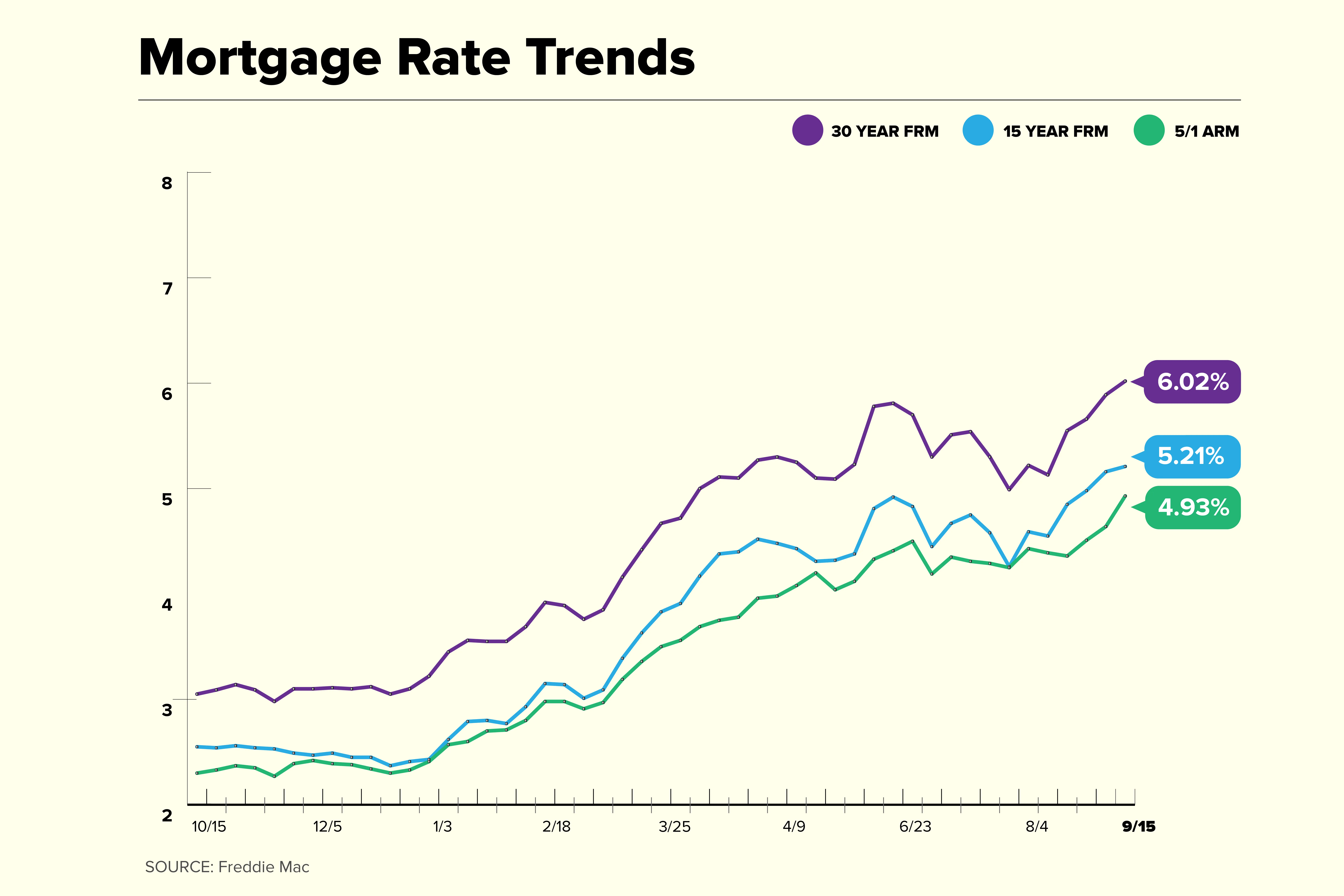

The Federal Reserve designs and implements policies to keep inflation and interest rates relatively low and stable. In the UK usually the longest term fixed mortgage you could normally get was five years. Without having to borrow money from somewhere.

With a mortgage from first financial youre golden. While a 401k loan helps you save on interest paymentsyoure paying. If you do proceed with a full application for a mortgage protection or other product your personal data will be retained for longer.

51 How much can the bank lend you for your mortgage. Lenders generally prefer borrowers that offer a significant deposit. Of course thats not to say that a high-income earner would want to put say 50 of their income towards housing costs especially when income can change over the life of a 25-year loan.

Residents can generally borrow up to 80 of the propertys assessed value whereas non-residents are limited to 6070 LTV. By law 401k loans are limited to 50000 or 50 of your account balance whichever is less within a 12-month period. With help from your real estate agent set a reasonable sale price for your home.

Funds are normally received very quickly. Note that your mortgage lender cant tell you who you can or cannot sell to but they are allowed to ask for a buyers pre-approval or proof of funds. Westpac will normally lend up to 80 of a standard residential propertys value.

In the US the Federal government created several programs or government sponsored. Your home value has increased considerably. The usual way to determine how much you can borrow with a mortgage would be to multiply your income by four.

How much can you borrow from your 401k. If you cant. Historically the most popular length people opt for is 25 years but in recent years the 30- and even 35-year mortgages are becoming more popular.

This mortgage finances the entire propertys cost which makes an appealing option. Borrowers can get preapproval from the company in as little as three minutes. This provides you a ballpark estimate of how much you can borrow from a lender.

There are up to 200000 so-called mortgage prisoners trapped in their current mortgage deal. Saving a bigger deposit. Including when you remortgage to a new lender as the new provider pays off the debt on the old deal you normally pay an exit fee which is usually a few hundred pounds.

For example if your salary is 25000 you could borrow a maximum of 100000. If a house is valued at 180000 a lender would expect a 9000. How Much Can You Afford to Borrow.

Before you can obtain a mortgage you must undergo a qualification process. You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. We also offer a 500 rebate on your closing costs Learn more about First-Time Home Buyer Loans.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. They typically request at least 5 deposit based on the value of the property. Once you have a savings buffer overpaying on your mortgage can be a low risk investment.

The mortgage pre-qualifying process is an informal assessment of your ability to repay a loan. They also can serve as collateral for Real Estate Mortgage Investment Conduits REMIC backed by HMBS H-REMICs. Data received as part of initial enquiries is normally kept for two years before being deleted.

Better Mortgage NMLS 330511 offers an online mortgage lending program in all states except Nevada. Loan repaid through normal 401k contributions. With Lenders Mortgage Insurance Westpac can lend up to 95 of a standard residential propertys value 90 of a vacant block of lands value.

21 H-REMIC transactions were issued in FY 2018 down from 25 in FY 2017. Homeowner Tax Deductions. If you miss your mortgage payments your guarantor has to cover them.

It also gives you an overall picture of whether you satisfy minimum requirements for a mortgage. A title search can run from 150 to 500. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018.

The entity to which you ask for the loan will not normally lend you 100 of its value. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. A modest rate of inflation will usually lead to low interest rates while concerns about rising inflation normally result in increased interest rates.

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

7 Questions Answered About Getting A Dutch Mortgage In 2022 Dutchreview

:max_bytes(150000):strip_icc()/chart-42ab2781198f4eb3802ca3b4adcc4ea5.png)

What Is A Mortgage

Is It Time To Withdraw Money Or Borrow From Your 401 K Piggy Bank Cnn Underscored Investing For Retirement Payroll Taxes Retirement

What Is 100 Mortgage Financing And How To Get It

250k Mortgage Mortgage On 250k Bundle

Money Tribune Income Tax Deduction For Home Loan Under Section 24 80c And 80ee Buying A Home Is A Costing Affair For Any Investing Income Tax Tax Deductions

Current Mortgage Interest Rates September 2022

What Is A Mortgage

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

What Is 100 Mortgage Financing And How To Get It

7 Questions Answered About Getting A Dutch Mortgage In 2022 Dutchreview

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Looking To Buy A House Soon Here S A Checklist To Make Sure You Don T Miss Out On Anything Before Y Home Buying Checklist Home Buying Check Your Credit Score

How Much Can I Borrow For My Mortgage Times Money Mentor

Pin On Small Quick Loan

Agbo5fvxuoyi1m